United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

______________________________________

|

| | | | | | | |

| Filed by the Registrant | | x | | Filed by a Party other than the Registrant | | ¨ | |

Check the appropriate box:

|

| | |

| x | Preliminary Proxy Statement | |

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

Advanced Emissions Solutions, Inc.

(Name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Check the appropriate box:

|

| |

x

| No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) Title of each class of securities to which transaction applies: |

| | 2) Aggregate number of securities to which transaction applies: |

| | 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) Proposed maximum aggregate value of transaction: |

| | 5) Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

¨

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) Amount Previously Paid: |

| | 2) Form, Schedule or Registration Statement No.: |

| | 3) Filing Party: |

| | 4) Date Filed: |

April [ ], 20182020

Dear Fellow Stockholder:

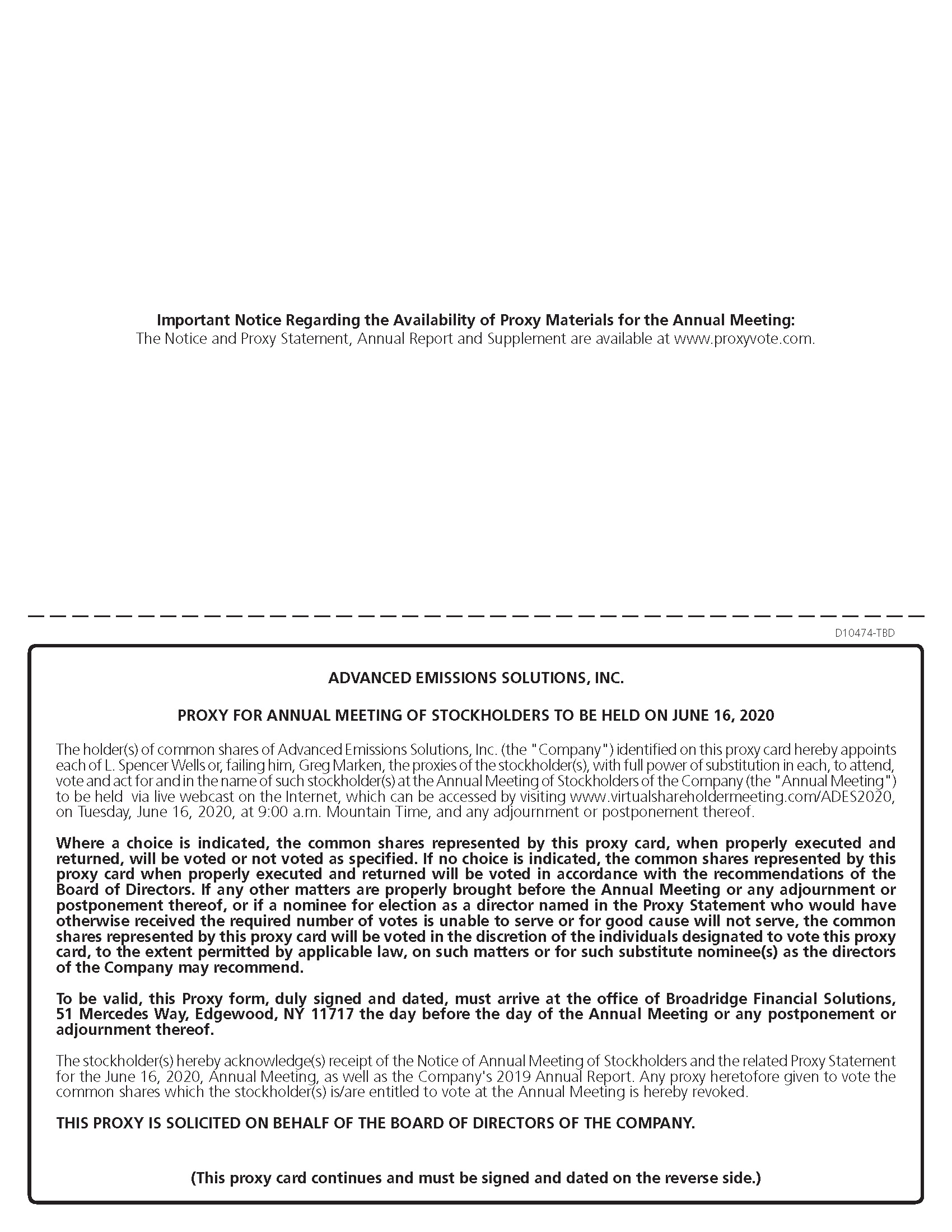

On behalf of the Board of Directors, we are pleased to invite you to the 20182020 Annual Meeting of Advanced Emissions Solutions, Inc.'s Stockholders, which will be held at 9:00 a.m. (local time)(Mountain Time) on June 19, 201816, 2020. We are pleased to announce that this year’s Annual Meeting will be a virtual meeting via live webcast on the Internet. Because of public health concerns associated with the coronavirus outbreak (COVID-19), we have changed our usual in-person meeting to a virtual meeting. You will be able to electronically attend the Annual Meeting and vote during the meeting by visiting www.virtualshareholdermeeting.com/ADES2020. To enter the Annual Meeting, you will need the 16-digit control number located in the Notice of Internet Availability of Proxy Materials or on your proxy card. We recommend that you log in at least 10 minutes before the Denver Marriott Tech Center located at 4900 S. Syracuse Street, Denver, Colorado 80237.meeting to ensure you are logged in when the meeting starts.

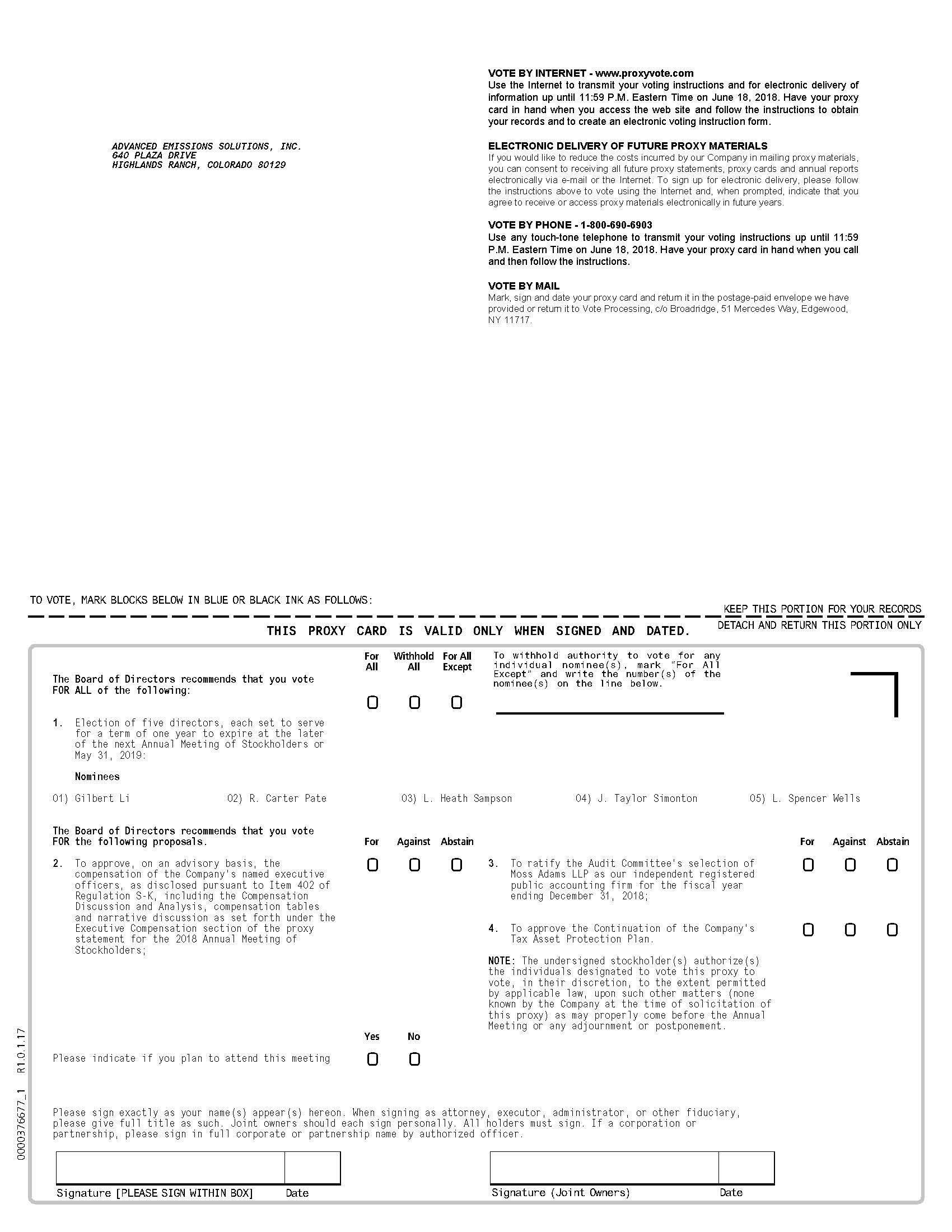

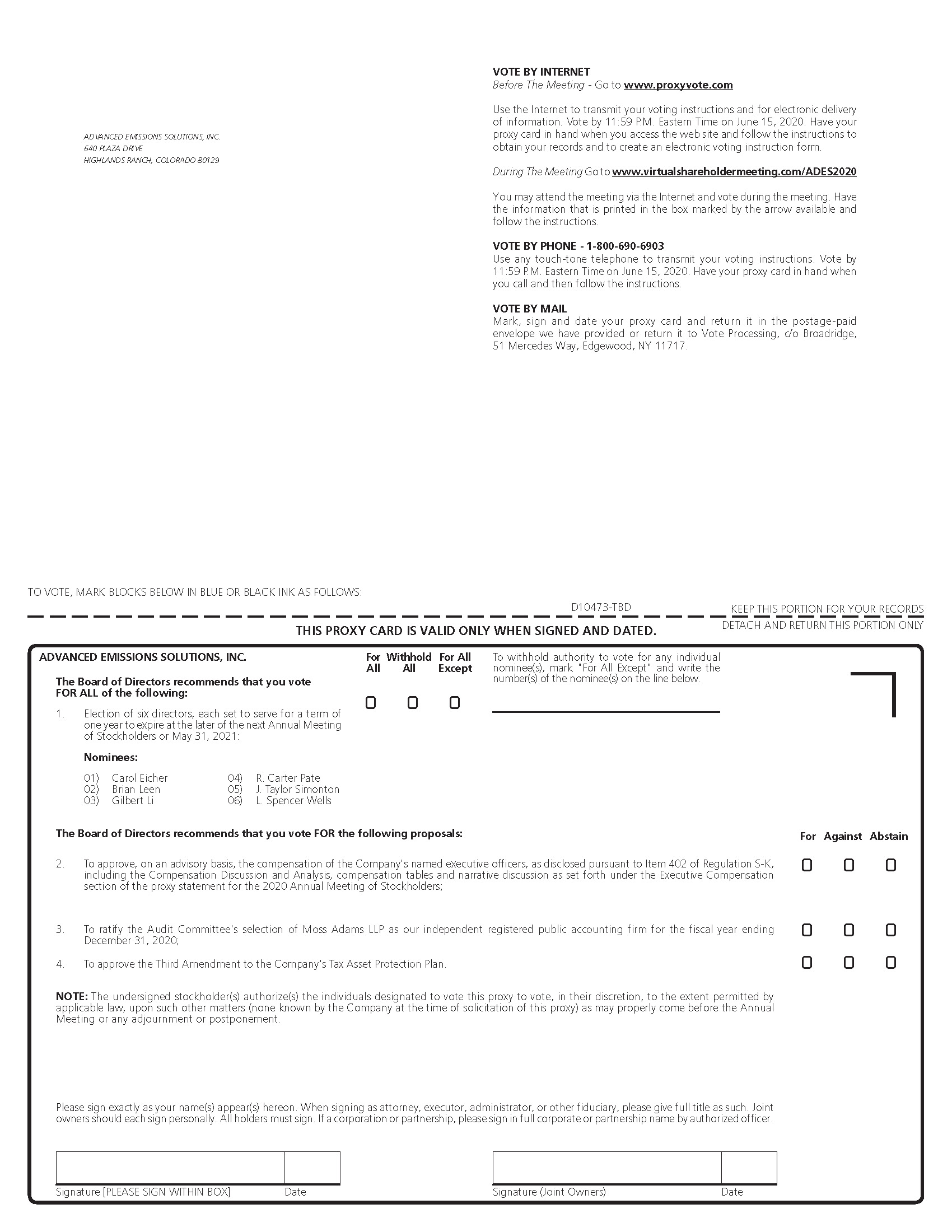

At the Annual Meeting, you will be asked to elect fivesix directors, provide your advisory approval on our executive compensation, ratify the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20182020 and approve the continuationThird Amendment of the Company's Tax Asset Protection Plan.

Your Board of Directors and management look forward to greeting those of you who are able to attend the Annual Meeting. The accompanying notice of meeting and this Proxy Statement provide specific information about the Annual Meeting and explain the various proposals. Please read these materials carefully.

Thank you for your continued support of and interest in our Company.

L. Heath SampsonGreg P. Marken

PresidentChief Financial Officer, Treasurer and Chief Executive OfficerSecretary

ADVANCED EMISSIONS SOLUTIONS, INC.

640 Plaza Drive, Suite 270

Highlands Ranch,Greenwood Village, Colorado 8012980111

Telephone: (888) 822-8617

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

The Annual Meeting of Stockholders of Advanced Emissions Solutions, Inc. (“ADES”("ADES" or the “Company”"Company"), a Delaware corporation, will be held at 9:00 a.m. (local time)(Mountain Time) on June 19, 2018 at16, 2020 via live webcast on the Denver Marriott Tech Center located at 4900 S. Syracuse Street, Denver, Colorado 80237, or at any postponementInternet, which can be accessed by visiting www.virtualshareholdermeeting.com/ADES2020, where you will be able to electronically attend the Annual Meeting and vote or adjournment thereof, for the following:

| |

| 1. | To elect fivesix directors of the Company; |

| |

| 2. | To approve, in an advisory vote, our executive compensation; |

| |

| 3. | To ratify the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018;2020; |

| |

| 4. | To approve the continuationThird Amendment of the Company's Tax Asset Protection Plan; and |

| |

| 5. | To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

Stockholders of record at the close of business on April 23, 201820, 2020 are entitled to notice of and to vote at the Annual Meeting.

Our stockholders are cordially invited to attend the Annual Meeting in person. Whether or not you planvia a virtual meeting. You will be able to electronically attend the Annual Meeting, we urge you toannual meeting as well as vote your sharesduring the live webcast of the meeting by telephone orvisiting www.virtualshareholdermeeting.com/ADES2020 and entering the 16‐digit control number included in our notice of Internet or by completing, signing and datingavailability of the availableproxy materials, on your proxy card and returning it promptlyor in the instructions that accompanied your proxy materials. We recommend that you log in at least 10 minutes before the meeting to ensure you are logged in when the Company.meeting starts.

Please call on our toll-free number (888-822-8617) if you require directions or have other questions concerning the meeting. Directions to our offices are also located on the back cover of this Proxy Statement.

By Order of the Board of Directors,

Greg P. Marken

Chief Financial Officer, Treasurer and Secretary

April [ ], 20182020

Important Notice

Regarding Internet Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on June 19, 201816, 2020

The Company’sCompany's Proxy Statement and Annual Report to Stockholders are Available at: www.proxyvote.com

TABLE OF CONTENTS

PROXY STATEMENT

This Proxy Statement is furnished to the stockholders of Advanced Emissions Solutions, Inc. (“ADES” or the “Company”), a Delaware corporation, ("ADES" or the "Company") in connection with the solicitation of proxies by the Company’s Board of Directors (the “Board”"Board"), to be voted at our annual meeting of stockholders (“("Annual Meeting”Meeting" or “meeting”"meeting") to be held at 9:00 AM (Mountain Time) on Tuesday, June 19, 2018, at the Denver Marriott Tech Center located at 4900 S. Syracuse Street, Denver, Colorado 80237,16, 2020, via virtual meeting, and any postponements or adjournments thereof. This Proxy Statement and accompanying form of proxy is first being made available to our stockholders on or about April 26, 2018.20, 2020. The shares represented by all proxies that are properly executed and submitted will be voted at the meeting in accordance with the instructions indicated thereon, and if no instructions are given, then to the extent permitted by law, in the discretion of the proxy holder. Throughout this Proxy Statement, the terms "we," "us" "our" and "our Company" refer to Advanced Emissions Solutions, Inc. and, unless the context indicates otherwise, our consolidated subsidiaries.

PARTICIPATION IN VIRTUAL MEETING

In accordance with Delaware law, the Board has authorized that the Annual Meeting be held via virtual meeting, and accordingly, stockholders and proxy holders virtually attending the Annual Meeting are deemed present in person for purposes of determining the presence of a quorum.

The only item of information needed to access the Annual Meeting from the website is the 16-digit control number located in the Notice of Internet Availability of Proxy Materials or on your proxy card.

Please have the notice of internet availability or proxy card in hand when you access the website and then follow the instructions. If you are a stockholder of record, you are already registered for the virtual meeting.

VOTING RIGHTS AND VOTE REQUIRED

Our Board has fixed the close of business on April 23, 2018,20, 2020 as the record date (the “Record Date”"Record Date") for determination of stockholders entitled to notice of and to vote at the meeting. On the Record Date, [ ] shares of our common stock were issued and outstanding, each of which entitles the holder thereof to one vote on all matters that may come before the Annual Meeting. We do not have any class of voting securities outstanding other than our common stock. An abstention or withholding authority to vote will be counted as present for determining whether the quorum requirement is satisfied. If a quorum exists, actions or matters other than the election of the Board are approved if the votes cast in favor of the action exceed the votes cast opposing the action unless a greater number is required by the Delaware General Corporation Law (the “DGCL”"DGCL") or our Second Amended and Restated Certificate of Incorporation. The fivesix nominees receiving the highest number of votes cast will be elected as directors. Abstentions will not affect the election of directors.

If, as of the Record Date your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then that firm or organization is the stockholder of record for purposes of voting at the Annual Meeting and you are considered the beneficial owner of shares held in "street name." If you are a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares held in your account. If you do not instruct your broker on how to vote your shares, your brokerage firm, in its discretion, may vote your shares on routine matters or they may elect not to vote your shares. The proposal to ratify the appointment of our independent registered public accounting firm for the fiscal year ending December 31, 20182020 is considered a “routine"routine matter,”" but the other proposals being voted on at the Annual Meeting are not considered “routine matters”"routine matters" and brokers will not be entitled to vote on those proposals absent specific instructions and authorization from the beneficial owners of the shares. If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute "broker non-votes." A broker non-vote occurs when a nominee holding shares for a beneficial holder does not have discretionary voting power and does not receive voting instructions from the beneficial owner. Broker non-votes on a particular proposal are considered present for purposes of determining a quorum, but will not be treated as shares present and entitled to vote on any proposal other than the ratification of our public accounting firm and accordingly will have no effect on such vote.

We invite beneficial owners to attend the Annual Meeting. If you are a beneficial owner and not a stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent and bring such proxy to the Annual Meeting. If you want to attend the Annual Meeting, but not vote, you must provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to April 23, 2018, a copy of the voting instruction card provided by your broker or other agent or other similar evidence of ownership.

A minimum of one-third of the shares of our common stock ("Common StockStock") issued and outstanding must be represented at the meeting in person or by proxy in order to constitute a quorum. Cumulative voting is not allowed for any purpose.

Unless instructions to the contrary are marked, or if no instructions are specified, shares represented by proxies will be voted:

FOR ALL the persons nominated by the Board for Directors, being: Carol Eicher, Brian Leen, Gilbert Li, R. Carter Pate, L. Heath Sampson, J. Taylor Simonton, and L. Spencer Wells;

FOR the approval, on an advisory basis, of the compensation of the Company’sCompany's named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis,

compensation tables and narrative discussion as set forth under the Executive Compensation section of this Proxy Statement;

FOR the ratification of the appointment of Moss Adams LLP as the Company’sCompany's independent registered public accounting firm for the fiscal year ending December 31, 2018;2020; and

FOR the approval of the continuationThird Amendment of the Company's Tax Asset Protection Plan.

We do not know of any other matter or motion to be presented at the Annual Meeting. If any other matter or motion should be presented at the Annual Meeting upon which a vote must be properly taken, to the extent permitted by law, the persons named in the accompanying form of proxy intend to vote such proxy in the discretion of such person as the directors of the Company may recommend, including any matter or motion dealing with the conduct of the Annual Meeting.

Voting by Mail, Facsimile, via the Internet or by Telephone

Stockholders whose shares are registered in their own names may vote by mailing or faxing a completed proxy card, via the internet or by telephone. Instructions for voting via the internet or by telephone are set forth on the enclosedincluded proxy card. To vote by mailing or faxing a proxy card, sign and return the available proxy card to the Company and your shares will be voted at the Annual Meeting in the manner you direct. If no directions are specified, your shares will be voted as described above.

If your shares are registered in the name of a bank or brokerage firm, you may be eligible to vote your shares over the internet or by telephone rather than by mailing a completed voting instructions card provided by the bank or brokerage firm. Please check the voting instructions card provided by your bank or brokerage house for availability and instructions. If internet or telephone voting is unavailable from your bank or brokerage house, please complete and return the voting instructions card provided by the bank or brokerage firm.

Any stockholder who completes a proxy or votes via the internet or by telephone may revoke the action at any time before it is exercised at the Annual Meeting by delivering written notice of such revocation to the Company's (c/o GregSecretary (Greg P. Marken, Secretary)Marken), 640 Plaza Drive, Suite 270, Highlands Ranch, Colorado,CO, 80129, by submitting a new proxy executed at a later date, or by attendingjoining the Annual Meetingvirtual meeting and voting such stockholder's shares in person.a manner different to his, her, or its previously

completed proxy card.

The Company is bearing the costs of this solicitation of proxies.

PROPOSAL ONE

ELECTION OF DIRECTORS OF THE COMPANY

Our Nominating and Governance Committee has recommended to our Board the slate of fivesix directors for election by our stockholders, and the Board approved the recommendation and the slate of directors. Each director will hold office until the next Annual Meeting of Stockholders and thereafter until a successor is elected and qualified. Cumulative voting is not permitted in the election of directors. IN THE ABSENCE OF INSTRUCTIONS TO THE CONTRARY, THE INDIVIDUALS NAMED IN THE ACCOMPANYING PROXY WILL VOTE IN FAVOR OF THE ELECTION OF THE FOLLOWING PERSONS NAMED AS OUR NOMINEES FOR DIRECTORS: CAROL EICHER, BRIAN LEEN, GILBERT LI, R. CARTER PATE, L. HEATH SAMPSON, J. TAYLOR SIMONTON AND L. SPENCER WELLS.

Each of the nominees has consented to be named herein and to serve if elected. We do not anticipate that any nominee will become unable or unwilling to accept nomination or election, but if this should occur, the persons named in the proxy intend to vote for the election in his or her stead of such other person as the Board may recommend. Because the Annual Meeting

will be held virtually this year, we anticipate that all directors will participate in the Annual Meeting this year. It is the regular

policy and practice of the Company that all directors who reside in the metropolitan Denver, Colorado area attend the Annual

Meeting in person. Last year a total of five directors, which included two directors who resided in the metropolitan Denver area, attended the annual meeting in person, and three directors join via phone.

Our board currently has seven members. Current director L. Heath Sampson is not standing for reelection at the Annual Meeting.

Detailed biographical information about each director nominee can be found under the Corporate Governance section of this Proxy Statement. The following table sets forth certain information, including expected Committee membership as of June 19, 2018,16, 2020, as to each director nominee of the Company: | | | Name | | Age | | Position and Offices | | Director Since | | Age | | Position and Offices | | Director Since |

| Carol Eicher | | | 61 | | Director, Chairman of Nominating and Governance Committee and Member of Audit Committee and Activated Carbon Committee | | 2019 |

| Brian Leen | | | 51 | | Director, Chairman of Activated Carbon Committee | | 2019 |

| Gilbert Li | | 40 | | Director, Chairman of Nominating and Governance Committee and Member of Audit Committee and Compensation Committee | | 2016 | | 42 | | Director, Member of Compensation Committee and Nominating and Governance Committee | | 2016 |

| R. Carter Pate | | 63 | | Director, Chairman of Compensation Committee and Member of Audit Committee and Nominating and Governance Committee | | 2016 | | 65 | | Director, Chairman of Compensation Committee and Member of Audit Committee and Nominating and Governance Committee | | 2016 |

| L. Heath Sampson | | 47 | | Director, President and Chief Executive Officer | | 2015 | |

| J. Taylor Simonton | | 73 | | Director, Chairman of the Audit Committee and Member of Nominating and Governance Committee | | 2014 | | 75 | | Director, Chairman of the Audit Committee and Member of Activated Carbon Committee | | 2014 |

| L. Spencer Wells | | 47 | | Director, Chairman of the Board and Member of Compensation Committee | | 2014 | | 49 | | Director, Chairman of the Board and Member of Compensation Committee | | 2014 |

No family relationship exists between any directors or executive officers.

Director Compensation information for the fiscal year ended December 31, 20172019 can be found under the "Director Compensation" section of this Proxy Statement.

Board Recommendation

Our Board recommends that you vote "FOR" all of the persons nominated above, being Carol Eicher, Brian Leen, Gilbert Li, R. Carter Pate, L. Heath Sampson, J. Taylor Simonton and L. Spencer Wells.

CORPORATE GOVERNANCE

Directors of the Company

The Nominating and Governance Committee of the Board seeks directors with strong reputations and experience in areas relevant to our strategy and operations, such as environmental and diversified chemical technologies, and government regulation and relations, as well as overall business acumen and experience in financial matters. Each of our current directors and the director nominees set forth in this Proxy Statement holds or has held senior executive positions in complex organizations and has operating experience that meets this objective, as described below. In these positions, the directors anddirector nominees have also gained experience in core management skills, such as strategic and financial planning, public company financial reporting, corporate governance, executive compensation, risk management and leadership development. The Nominating and Governance Committee also believes that each of the directors anddirector nominees has other key attributes that are critical to the composition of an effective Board: integrity and demonstrated impeccable ethical standards, sound judgment, analytical skills, the ability to work together in a constructive and collaborative fashion and the commitment to devote significant time and energy to service on the Board and its Committees.

The specific experience, qualifications and background of each director for election by our stockholders is as follows:

L. Spencer WellsCarol Eicher was appointed as a director of the Company in April 2019. Carol has extensive public company executive leadership and operational expertise, having worked more than 35 years in the chemical industry. She held senior management roles with Dow Chemical Co., Rohm and Haas Co., Ashland, Inc. and E.I. DuPont de Nemours and Co. In addition, she was CEO and Chairman of a private equity portfolio company and led the successful sale of that company. She has extensive public and private company board leadership experience having served on public company boards for more than

10 years, with a specific expertise in Governance.

Director Qualifications:

Tennant Company (NYSE: TNC) since 2008: independent director, Chair of the Governance Committee, member of the Compensation Committee, former member of the Audit Committee

A Schulman Company (NASDAQ:SHLM): 2017-2018; independent director and member of the Audit and Compensation Committees

Innocor, Inc.: 2014 -2017 CEO; 2017-2018 non-executive board chairman

Arconic Corporation (NYSE: ARNC) since 2020: independent director, member of Governance Committee

Brian Leen was appointed as a director of the Company in February 2019. Previously, Mr. Leen served as President and Chief Executive Officer of ADA Carbon Solutions, LLC ("Carbon Solutions") until December 7, 2018, on which date the Company acquired Carbon Solutions (the "Carbon Solutions Acquisition"). Mr. Leen is now the President and Chief Executive Officer of Gopher Resource, LLC, a leading provider of environmental services to battery manufacturers. Mr. Leen has over 25 years of experience in the specialty chemicals and materials industry. Under his leadership, Carbon Solutions grew to become the largest provider of mercury control technology to the coal fired power industry increasing its market share of activated carbon fivefold in eight years. Prior to joining Carbon Solutions in 2010, he was President of the North American printing ink operations for Sun Chemical Corporation, a global provider of printing inks and pigments with approximately $3.5 billion in revenues and 10,000 employees. He also led the Performance Pigments Group of Sun Chemical, a global leader in the development, manufacture and sale of organic pigments. Mr. Leen has a diverse background running global businesses and a track record for driving growth. He has led various M&A efforts and strategic growth initiatives along with operational efficiency efforts including ERP deployment and Six Sigma. Mr. Leen holds a Bachelor's in Marketing from the University of Kentucky and is a graduate of the Executive Management Program at the University of Michigan.

Director Qualifications:

Leadership Experience - Held various business leadership roles with overall responsibility for the financial performance of the business and the development and execution of a long term growth strategy. Led multinational businesses ranging in size and scope up to approximately $1.0B in revenue and 2,000 employees as President of NAI / Sun Chemical Corp. Served on several boards and as a board advisor to various portfolio companies of Energy Capital Partners (ECP) and industry associations.

Industry Experience - Former President and CEO of Carbon Solutions for eight years, led the company from approximately 10% market share to over 50% of the market share for activated carbon in mercury control; over 25 years of experience in B-to-B businesses most significantly in specialty chemicals

Finance Experience - Participation and leadership of several M&A activities on both buy and sell side initiatives including execution and management of international joint ventures. Experience in term loan acquisition, enterprise recapitalization and relationship management.

Gilbert Li has served as a director since 2014 and as Chairman of the Board of the Company since 2016. Mr. Wells has over 15 yearsLi is currently the Co-Founder and Managing Partner of experience asAlta Fundamental Advisers, a financial analyst and is a Partner at Drivetrain Advisors providing extensive knowledgeprivate investment company, holding this position since January 2013. Beginning on portfolio management, proprietary trading, and special situation expertise. Before joining Drivetrain Advisors in 2013, Mr. Wells served as a Senior Advisor (from 2012 to 2013) and as a Partner (from 2010 to 2012) at TPG Special Situations Partners, during which time he created and managed an investment portfolio approximated at $2.5 billion. From 2002 until 2009, Mr. Wells served as a Partner and a Portfolio Manager at Silverpoint Capital. While at Silverpoint, he covered the energy, chemicals, and building products sectors and managed an investment portfolio estimated at $1.3 billion. Mr. Wells has served as a director of Town Sports International Holdings, Inc. (NASDAQ: CLUB) since 2015 and as a director of NextDecade Corporation (NASDAQ: NEXT) since August 2017. He also serves as a director of three other private companies. Since June 2016,February 1, 2018, he has also served as a manager on the Board of Managers of Tinuum Group, LLC ("Tinuum Group"), a related party. Mr. Wells is a Trustee, a member of the Investment Committee and Finance Committee, and Co-Chair of the Development Committee for Western Reserve Academy. Mr. Wells holds a B.A. in psychology from Wesleyan University and an M.B.A. from Columbia Business School.

Director Qualifications:

Leadership Experience - Senior Advisor and a prior partner at TPG Special Situations Partners, Director for the Center for Music National Service, current director for Town Sports International Holdings, Inc. and NextDecade Corporation and three other private companies, and Trustee and Co-Chair of the Development Committee for Western Reserve Academy.

Industry Experience - Through his various roles as a financial analyst, he has covered the energy chemicals and building products sectors.

Finance Experience - Extensive and varied experience with over 20 years of involvement as a financial analyst.

Gilbert Li has served as a director of the Company since 2016 and currently is the Co-Founder and Managing Partner of Alta Fundamental Advisers, a private investment company, since January 2013. Since February 1, 2018, he has served as a manager on the Board of Managers of Tinuum Group.. He has spent his career focused on value orientedvalue-oriented investing across the capital structure. From January 2009 through January 2013, Mr. Li was an investment analyst for JMB Capital Partners, a $1.3 billion hedge fund. He has also previously held the roles of portfolio manager, trader and investment analyst at Merrill Lynch, Watershed Asset Management and J.P. Morgan Investment Management. Mr. Li attended the University of California, Berkeley with majors in chemical engineering and material science engineering and a minor in business administration.

Director Qualifications:

Leadership Experience - Co-Founder and Managing Partner of Alta Fundamental Advisers.

Industry Experience - Invested, analyzed, and traded many energy, alternative energy, coal, and tax credit-related companies.

R. Carter Pate has served as a director of the Company since 2016. Since May 2015, he has served as a director of BioScrip, Inc. (NASDAQ: BIOS) and is currently the its Chairman of the Board. Mr. Pate is currently the Interim Chief Executive Officer of Providence Services Corporation (NASDAQ: PRSC), a position he has held since 2017. He is also the Founder and Chief Executive Officer of Phoenix Effect, LLC, serving as a consultantConsultant and advisory board memberAdvisory Board Member to public and

private boardsBoards of directorsDirectors since 2014. From 2011 to 2014, Mr. Pate was the former interim Chief Executive Officer of Providence Service Corporation, Inc. (NASDAQ: PRSC), which is a publicly held corporation headquartered in Stamford, Connecticut. Mr. Pate previously served as Chief Executive Officer of MV Transportation, Inc., the largest privately-owned passenger transportation contracting firm based in the U.S., and continues from 2011 to serve as an independent strategic advisor to MV Transportation.2014. From 1996 to 2011, Mr. Pate was employed by PricewaterhouseCoopers, LLP ("PwC") in various positions including, one of the world’s largest accounting and professional service firms. From 2010 to 2011, he was the U.S. and Global Managing Partner of PwC’sPwC's Capital Projects and Infrastructure practice (2010practice. From 2008 to 2011),2010, he was the Global and U.S. Managing Partner of PwC’sPwC's Health Care Practice, (2008and from 2005 to 2010),2008, he was the U.S. Managing Partner of Government Services (2005Services. From 2004 to 2008),2005, Mr. Pate was PwC's Managing Partner of U.S. Markets, (2004and from 2000 to 2005),2004, Mr. Pate was PwC's Managing Partner of Financial Advisory Services (2000 to 2004) andServices. He served as a Partner and Leader in thePwC's U.S. Restructuring Practices (1996from 1996 to 2000).2000. Mr. Pate previously served as a director, Interim President and Chief Executive Officer of Sun Television and Appliances, Inc., a national retailer, as a director and Chief Executive Officer of Sun Coast Industries, Inc. and as Director of Finance at William Hudson Chemical Trading. He also founded his own management consulting firm. Mr. Pate has a Master's degree in accountingAccounting and information managementInformation Management from the University of Texas at Dallas and a B.S. degree in accountingAccounting from Greensboro College and is a CPA.

Director Qualifications:

Leadership Experience - Founder and Chief Executive Officer of Phoenix Effect, LLC, Chief Executive Officer of MV Transportation, director, Interim President and Chief Executive Officer of Sun Television and Appliances, director and Chief Executive Officer of Sun Coast Industries, Chairman of the Board of Red Lion Hotels (NYSE: RLH) director of several public and private companies and multiple leadership positions at PwC.

Industry Experience - During Mr. Pate's years as a Partner in charge of PwC's U.S. Advisory Practice, which included the Advisory energy practice which included a number ofreported to him and he served as an advisor to several oil field services firms as well as a fluid catalyst crackingFluid Catalyst Cracking (FCC) manufacturer. He also served as an advisor to one of America's largest energy companies in a multi-year restructuring effort. As the U.S. Managing Partner

of PwC's U.S. Governmentgovernment practice, he was involved in consulting relationships with U.S. Government contracting energy companies. He maintains his Department of DefenseDoD Top Secret Clearance.

L. Heath Sampson is the President and Chief Executive Officer and a director of the Company. Mr. Sampson has served in this role since April 2015. Prior to his appointment as Chief Executive Officer, Mr. Sampson served as Chief Financial Officer and Treasurer of the Company from August 27, 2014. Since April 2015 has served as a Manager on the Board of Managers of Tinuum Group. Mr. Sampson is a National Association of Corporate Directors (NACD) Board Leadership Fellow. He demonstrates his commitment to the highest standards of exemplary board leadership by earning NACD Fellowship — The Gold Standard Director Credential — a continuous program of study that empowers directors with the latest insights, intelligence, and leading boardroom practices. Prior to joining the Company and from 2009 to 2014, he served as Chief Financial Officer of Square Two Financial, a $500 million private equity backed consumer collections company, where he led a corporate restructuring project. From 2007 to 2009, Mr. Sampson served as Chief Financial Officer of First Data Financial Services, a business unit of First Data Corporation, a large-market global SEC registrant, and led strategy development for the $2.5 billion business unit with over 15,000 employees. From 2005 to 2007, he served First Data Corporation as the business unit Chief Financial Officer for both the innovative payments and integrated payment systems business units. At First Data Corporation, Mr. Sampson also led corporate restructuring projects and was instrumental in a large solution-based corporate turnaround sales effort. He was also employed by Arthur Andersen LLC from the mid-1990s until the early 2000s. During his time at Arthur Andersen LLP, Mr. Sampson served as a manager of audit services and a senior manager of business and risk consulting. Mr. Sampson holds a Bachelor of business administration-accounting and Masters of accountancy from the University of Denver.

Director Qualifications:

Leadership Experience - President and Chief Executive Officer of the Company; former Chief Financial Officer of the Company, Square Two Financial and multiple business units of First Data Corporation including First Data Financial Services; former manager of audit services and former senior manager of business and risk consulting at Arthur Andersen LLP.

Industry Experience - President and Chief Executive Officer and former Chief Financial Officer of the Company.

Finance Experience - former Chief Financial Officer of the Company; former Chief Financial Officer of Square Two Financial and multiple business units of First Data Corporation including First Data Financial Services; former manager of audit services and former senior manager of business and risk consulting at Arthur Andersen LLP; Bachelor of business administration-accounting and Masters of accountancy from the University of Denver.

J. Taylor Simonton has served as a director of the Company since 20142014. Mr. Simonton is a director and has over 46 yearsmember of experiencethe Audit Committee (Chairman effective May 2018) and Governance Committee since May 2017 of Master Chemical Corporation, a private company in financial accountingthe specialty industrial fluids industry. From May 2017 to March 2020, he was a director and auditing. SinceAudit Committee Chairman of Surna Inc., which develops innovative technologies and products that monitor, control and address the energy and resource intensive nature of indoor cultivation. From October 2013 to June 2018, Mr. Simonton has beenwas a director of Escalera Resources Co. f/k/a Double Eagle Petroleum (OTC: ESCRQ), a developer of natural gas and crude oil properties in the Rocky Mountain region. He currently servesserved Escalera Resources as the Audit Committee Chair and a member of the Compensation and Nominating and Governance Committees. From September 2008 to July 2015, Mr. Simonton was a director of Crossroads Capital, Inc. f/k/(now a BDCA Venture, Inc. (formerly NASDAQ: XRDC), a business development company and closed-end mutual fund.liquidating trust). He served Crossroads Capital as the Lead Director, Chair of the Audit Committee, and as a member of the Nominating & Governance Committee and Compensation and Valuation CommitteesCommittee, and also served as the Chair of the Valuation Committee from 2008 to 2011. Mr. Simonton served as a director and Chair of the Audit Committee for Zynex, Inc. (OTC: ZYXI) from October 2008 to January 2014. He served as a director, Chair of the Audit Committee (2005-2009), and a member of the Nominating and Governance Committee of Red Robin Gourmet Burgers, Inc. (NASDAQ: RRGB) from September 2005 to May 2013. Mr. Simonton was a member of the Board of Directors of the Colorado Chapter of the National Association of Corporate Directors (“NACD”("NACD") from September 2005 to July 2015, serving at various times as the Chairman, President, Treasurer and Publicity Chair/Editor. Mr. Simonton is a Board Leadership Fellow, the highest director credential of NACD. He is a member of the American Institute of CPAs and Colorado Society of CPAs. For 35 years, Mr. Simonton served at PwC, one of the world's largest accounting and professional services firms, including 23 years as an Assurance Partner and seven years in the firm’sfirm's SEC Department of its National Professional Services Group, four of which were international. Mr. Simonton received a B.S. degree in accounting from the University of Tennessee and is a CPA.

Director Qualifications:

Leadership Experience - Director and Chair of the Audit Committee of Master Chemical Corporation (private company); former Director and Chair of the Audit Committee of Surna Inc.; former Director and Chair of the Audit Committee of Escalera Resources Co.; previously Lead Director, and Chair of the Audit Committee of Crossroads Capital, Inc.,; former Director and Chair of the Audit Committee for Zynex, Inc., Red Robin Gourmet Burgers, Inc., and one other public company; Chairman, President, and Treasurer of the Board of Directors of the Colorado Chapter of NACD; Board Leadership Fellow, the highest director credential of NACD; and Colorado 2014 Outstanding Public Company Director, as awarded by the Denver Business Journal and NACD-Colorado.

Industry Experience - Varied experience throughout the years at PwC in the industry and as a former director of Escalera Resources Co., a developer of natural gas and crude oil properties in the Rocky Mountain region.region and more than five years as a director of Advanced Emissions Solutions, Inc.

Finance Experience - Extensive and varied experience for over 4645 years in financial accounting and auditing, including 35 years at PwC. HeMr. Simonton possesses a CPA and is a member of the American Institute of CPAs and Colorado Society of CPAs.

L. Spencer Wells has served as a director since 2014 and as Chairman of the Board of the Company since 2016. Mr. Wells has over 15 years of experience as an investor and financial analyst and is a founding Partner of Drivetrain Advisors a provider of fiduciary services to the alternative investment community. Prior to founding Drivetrain Advisors in 2013, Mr. Wells served as a Senior Advisor at TPG Special Situations Partners from 2010 to 2012. Mr. Wells currently serves on the Boards of several public and private companies, among them Town Sports International, Inc., NextDecade Corporation, Vanguard Natural Resources, Inc., Parker Drilling Company, Vantage Drilling International and Jones Energy, Inc. Mr. Wells has previously served on the Boards of public companies over the last five years, including Roust Corporation, Affinion Group, Inc. and Syncora Holdings, Ltd. From 2010 to 2012, Mr. Wells was a partner of TPG Special Situations Partners, during which time he helped to create and manage an investment portfolio approximated at $2.5 billion. From 2002 until 2009, Mr. Wells served as a Partner and a Portfolio Manager at Silverpoint Capital. While at Silverpoint, he covered the energy, chemicals and building products sectors and managed an investment portfolio estimated at $1.3 billion. Mr. Wells holds a B.A. in psychology from Wesleyan University and an M.B.A. from Columbia Business School.

Director Qualifications:

Leadership Experience - Extensive experience as a corporate board member. Senior Advisor and a prior partner at TPG Special Situations Partners, Director for the Center for Music National Service,

prior Director for Alinta Holdings and Kerogen Resources, and Trustee and Co-Chair of the Development Committee for Western Reserve Academy.

Industry Experience - Through his various roles as a financial analyst and director, he has covered the energy chemicals and building products sectors.

Finance Experience - Extensive and varied experience with over 15 years of involvement as a financial analyst. Currently serves on the Audit Committees of two public companies and one private company.

Director Independence

Our current Board consists of sixfive independent directors, as defined in NASDAQ Marketplace Rule 4200(a)(15). In our fiscal year 2017,2019, all directors other than Mr. Sampson and Mr. Leen, who joined the Board on February 27, 2019, qualified as "independent directors." The Board maintains audit, compensation, and nominating and governance committees, each of which was and is comprised solely of independent directors. The charter of each committee is available on our website at www.advancedemissionssolutions.com under the "Leadership & Governance" section of "ADES Investors."

Board Meetings and Committees

Our Board is responsible for establishing broad corporate policies and monitoring the overall performance of the Company. However, in accordance with corporate legal principles, the Board is not involved in day-to-day operating matters. Members of the Board are kept informed of the Company’sCompany's business by participating in Board and committee meetings, by reviewing analysis and reports sent to them weekly and monthly, and through discussions with the CEO and other officers.

The Board met 1510 times in 2017.2019. At each of the Board meetings, the independent directors were polled to determine if they believed an "executive session" was needed. In 2017,2019, the Board held fournine executive sessions where management of the Company was excluded. The Audit Committee met nineseven times in 2017.2019. The Compensation Committee met four times in 2017.2019. The Nominating and Governance Committee met seven times in 2019. The Activated Carbon Committee met five times in 2017.2019. All of the directors were present for more than 75% of the meetings of the Board and the committees of which they were members.

Our Board is currently comprised of seven members--the five current directors nominated for re-election at this annual meeting and A. Bradley Gabbard and Derek C. Johnson. Messrs. Gabbard and Johnson have chosen not to stand for re-election to the Board at the annual meeting. Accordingly, as permitted by our bylaws, the Board has reduced the size of the board from seven members to five members, effective as of the date of the annual meeting.

Stockholder Communications to Directors

Any stockholder may communicate directly with the Board (or any individual director) by writing to the Chairman of the Board, Advanced Emissions Solutions, Inc., 640 Plaza Drive, Suite 270 Highlands Ranch, ColoradoCO 80129 or by emailing the Board through the "Contact the Board" link on our website at www.advancedemissionssolutions.com. Any such communication should state the number of shares beneficially owned by the stockholder making the communication. Provided that such communication addresses a legitimate business issue, the Company or the Chairman will forward the stockholder's communication to the appropriate director. For any communication relating to accounting, auditing or fraud, such communication will be forwarded promptly to the Chairman of the Audit Committee.

Code of Ethics

We have adopted a Code of Ethics and Business Conduct that includes a code of ethics as defined in Item 406(b) of SEC Regulation S-K. Our Code of Ethics and Business Conduct incorporates our Insider Trading Policy, which applies to our officers, directors, and employees, including the principal executive officer, principal financial officer, principal accounting officer or controller or other persons performing similar functions. A copy of our Code of Ethics and Business Conduct is available on our website at www.advancedemissionssolutions.com. We intend to disclose any amendments to our Code of Ethics and Business Conduct, or waivers of such provisions granted to executive officers and directors, on our website.

Board Leadership Structure and Role in Risk Oversight

We have a policy of keeping the roles of Chief Executive Officer and Chairman of the Board separate, and the roles are currently filled by two different individuals. We believe this arrangement is appropriate as it recognizes the distinction between the role played by the Chief Executive Officer, which is a position being more heavily oriented towards day-to-day management, while the Chairman functions as an independent director, whose role is to oversee the Board and is also able to participate in and chair executive sessions of the Board.

The Board has designated the Audit Committee to take the lead in overseeing risk management, and the Audit Committee periodically reports to the Board regarding briefings provided by management and advisors as well as the Audit Committee’sCommittee's own analysis and conclusions regarding the adequacy of the Company’sCompany's risk management processes. In addition to this compliance program, the Board encourages management to promote, and management is committed to promoting, a corporate culture that incorporates risk management into the Company’sCompany's strategy and day-to-day business operations. The Board and management continually work together to assess and analyze our most likely areas of risk.

Audit Committee

Our Board has an Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”"Exchange Act"). Mr. Simonton currently serves as the Chairman of the Audit Committee. For 2017,2019, our Board appointed Messrs. Simonton Johnson,and Pate and Ms. Eicher to serve on the Audit Committee. For 2018, our Board appointed Messrs. Simonton, Li and Pate to serve on the Audit Committee. Our Board determined that Mr.Messrs. Simonton and Mr. Pate and Ms. Eicher are each an "audit committee financial expert." Each Audit Committee member is “independent”"independent" as that term is used in the listing requirements for the NASDAQ Stock Market, and a brief listing of his relevant experience is stated in his biography above under the caption entitled "Directors of the Company."

The role and functions of the Audit Committee are set out in the Audit Committee Charter, originally adopted by the Company’sCompany's Board and most recently amended on August 11, 2016. The role of the Audit Committee is one of oversight of the services performed by the Company’sCompany's independent registered public accounting firm. The Audit Committee’sCommittee's functions include the following: reviewing and assessing the Audit Committee Charter annually; overseeing the Company’sCompany's compliance with legal, ethical and regulatory requirements, including the Code of Ethics and Business Conduct and approving related party transactions; overseeing the Company’sCompany's processes to identify and manage business and financial risk; appointing, approving the compensation of and reviewing the Company’sCompany's relationships with its independent registered public accounting firm and/or other auditors and assessing the impact such relationships may have on the auditors’auditors' objectivity and independence; taking other appropriate action to oversee the independence of the outside auditors; reviewing and considering the matters identified in Auditing Standard No. 1301 adopted by the Public Company Accounting Oversight Board (“PCAOB”("PCAOB") with the outside auditors and management; reviewing and discussing the Company’sCompany's financial statements and report on internal control with the outside auditors and management; reviewing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC; and reporting to the Board on all such matters. In performing its oversight function, the Audit Committee relies upon advice and information received in its discussions with the Company’s management and independent registered public accounting firm. The Audit Committee pre-approves all audit or non-audit services performed by our independent registered public accounting firm in accordance with Audit Committee policy and applicable law.

Compensation Committee

For 2017,2019, our Board appointed a Compensation Committee currently consisting of Messrs. Li, Pate and Simonton.Wells. Mr. Pate currently serves as the chairpersonChairman of the Compensation Committee. For 2018, our Board appointed a Compensation Committee consisting of Messrs. Li, Pate and Wells. The responsibilities of the Compensation Committee, as

set forth in the Compensation Committee Charter include reviewing our executive compensation programs to analyze their alignment with attracting, retaining and motivating our executive officers to achieve our business objectives; establishing annual and long-term performance goals for our executive officers and evaluating their performance in light of such goals; reviewing, approving and, when appropriate, making recommendations concerning our long-term incentive plans; reviewing and making recommendations regarding stockholder proposals related to compensation; and administering our equity-based and employee benefit plans. See “Executive Compensation”"Executive Compensation" below for additional information.

Nominating and Governance Committee

For 2017,2019, our Board appointed a Nominating and Governance Committee currently consisting of Ms. Eicher and Messrs. Johnson, Li and Simonton. Mr. Johnson servedPate. Ms. Eicher currently serves as the chairmanChairman of the Nominating and Governance Committee. For 2018, our Board appointed Messrs. Li, Pate and Simonton to serve on the Nominating and Governance Committee. The responsibilities of the Nominating and Governance Committee include recommending the number of directors to serve on the Board; selecting director nominees for the Board; reviewing director compensation and benefits; submitting the same to the entire Board for approval; overseeing the annual self-evaluation of the Board and its committees; recommending the structure and composition of Board committees to the entire Board for approval; monitoring in conjunction with the Audit Committee compliance with our Code of Ethics and Business Conduct; granting any waivers thereto with respect to directors and executive officers; recommending individuals to serve as ChairpersonChairman of the Board and Chief Executive Officer; and reviewing the Chief Executive Officer’sOfficer's recommendations for individuals to serve as executive officers and analyzing and recommending such persons to the Board.

Criteria established for the selection of candidates for the Board include:

| |

a. | An understanding of business and financial affairs and the complexities of an organization that operates as a public company; |

| |

b. | A genuine interest in representing all of our stockholders and the interests of the Company overall; |

| |

c. | A willingness and ability to spend the necessary time required to function effectively as a director; |

| |

d. | An open-minded approach to matters and the resolve and ability to independently analyze matters presented for consideration; |

| |

e. | A reputation for honesty and integrity that is above reproach; |

| |

f. | Any qualifications required of independent directors by the NASDAQ Stock Market and applicable law; and |

| |

g. | As to any candidate who is an incumbent director (who continues to be otherwise qualified), the extent to which the continuing service of such person would promote stability and continuity amongst the Board as a result of such person’s familiarity and insight into the Company’s affairs, and such person’s prior demonstrated ability to work with the Board as a collective body. |

An understanding of business and financial affairs and the complexities of an organization that operates as a public company;

A genuine interest in representing all of our stockholders and the interests of the Company overall;

A willingness and ability to spend the necessary time required to function effectively as a director;

An open-minded approach to matters and the resolve and ability to independently analyze matters presented for consideration;

A reputation for honesty and integrity that is above reproach;

Any qualifications required of independent directors by the NASDAQ Stock Market and applicable law; and

As to any candidate who is an incumbent director (who continues to be otherwise qualified), the extent to which the continuing service of such person would promote stability and continuity amongst the Board as a result of such person's familiarity and insight into the Company's affairs, and such person's prior demonstrated ability to work with the Board as a collective body.

Director nominees are generally identified by our directors, stockholders or officers based on industry and business contacts. Regardless of the source of the nomination, nominees are interviewed and evaluated by the Nominating and Governance Committee, other members of the management team, and the Board as deemed appropriate by the Nominating and Governance Committee. The Nominating and Governance Committee then presents qualified candidates to the Board for a final discussion and vote.

We do not have a formal policy with respect to the consideration of diversity in the identification of director nominees, but the Nominating and Governance Committee strives to select candidates for nomination to the Board with a variety of backgrounds and complementary skills so that, as a group, the Board possesses the appropriate talent, skills, perspectives and expertise to oversee the Company’sCompany's businesses.

Under the Nominating and Governance Committee Charter, the Nominating and Governance Committee will consider nominees submitted by our stockholders. Recommendations of individuals that meet the criteria set forth in the Nominating and Governance Committee Charter for election at our 20182021 Annual Meeting of Stockholders may be submitted to the Nominating and Governance Committee in care of Greg P. Marken, Chief Financial Officer and Secretary, at 640 Plaza Drive, Suite 270, Highlands Ranch, ColoradoCO 80129 no later than December 28, 2018.31, 2020.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Messrs. Li, Pate, and Simonton served as members of the Company’s Compensation Committee during all of the fiscal year ended December 31, 2017. No current member of the Compensation Committee is or was an officer of the Company or any of its subsidiaries or had a relationship requiring disclosure under Item 404 of Regulation S-K. Additionally, no relationships requiring disclosure under Item 407(e)(iii) of Regulation S-K exists or existed during the fiscal year ended December 31, 2017.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Review and Approval of Related Party Transactions

Our Board recognizes that related party transactions present a heightened risk of conflicts of interest and/or improper valuation (or the perception thereof) and therefore has adopted a written policy with respect to all related party transactions involving the Company. Under this policy, any related party transaction, as defined (which excludes transactions available to all employees generally and transactions involving less than $5,000), may be consummated or may continue only if:

| |

1. | The Audit Committee has approved or ratified such transaction in accordance with the guidelines set forth in the policy and if the transaction is on terms comparable to those that could be obtained in arm’s length dealings with an unrelated third party; |

| |

2. | The transaction has been approved by the disinterested members of the Board; and |

| |

3. | The compensation with respect to such transaction has been approved by our Compensation Committee. |

Management must refer to the Audit Committee all proposed related party transactions at its first regularly scheduled meeting each year. After review, the Audit Committee will approve or disapprove such transactions and at each subsequently scheduled meeting, and management must update the Audit Committee as to any material change to those proposed transactions. If management recommends any additional related party transactions after such meeting, such transactions may be presented to the Audit Committee for approval or preliminarily entered into by management subject to ratification by the Audit Committee. If the Audit Committee does not ratify the transaction, however, management must make all reasonable efforts to cancel or annul such transaction.

Any material related party transaction must be disclosed to our full Board, and management must assure that all related party transactions are approved in accordance with any requirements of our financing or other agreements.

Related Party Transactions

Board of Director Matters

On May 5, 2017, the Board of the Company adopted a Tax Asset Protection Plan (the "TAPP”"TAPP") in an effort to protect stockholder value by attempting to diminish the risk that the Company’sCompany may be limited to its ability to use its net operating losses and general business credit carry-overs (collectively, the "Tax Attributes") to reduce potential future federal income tax obligations. If the Company experiences an “ownership"ownership change,”" as defined in Section 382 of the Internal Revenue Code, its ability to use the Tax Attributes may be substantially limited, and the timing of the usage of the Tax Attributes could be substantially delayed, which could therefore significantly impair the value of that asset. The TAPP is intended to act as a deterrent to any person acquiring beneficial ownership of 4.99% or more of the Company’s outstanding common stock ("Common Stock")Stock without the approval of the Board. The Board may, in its sole discretion, exempt any person from triggering the shareholder rights described in the TAPP.

On April 6, 2018, the Board approved the First Amendment to the Tax Asset Protection Plan (the "Amendment") that amended the TAPP. The Amendment extended the duration of the TAPP to December 31, 2019. At the Company's 2018 annual meeting, the Company's stockholders approved the Amendment. On April 5, 2019, the Board approved the Second Amendment to the Tax Asset Protection Plan (the "Second Amendment") that further amends the TAPP, as amended. The Second Amendment extended the duration of the TAPP to December 31, 2020. At the Company's 2019 annual meeting of stockholders, the Company's stockholders approved the Second Amendment.

Gilbert Li, a director of the Company, is the Co-Founder and Managing Partner of Alta Fundamental Advisers ("Alta"), a private investment company ("Alta"). Altathat beneficially owned as of March 31, 20182020 approximately 6.15%10.75% of the Company’sCompany's outstanding Common Stock. In each of 2018 and 2019, Alta requested an exemption under the TAPP for the acquisition or ownership of outstanding common stock of the Company (the(individually, the "Alta Exemption Request") in order to purchase additional shares of Common Stock without triggering the shareholder rights described in the TAPP.

On December 4, 2017,November 6, 2018 and November 25, 2019, respectively, the Board, with Mr. Li abstaining, and the Audit Committee of the Board, approved theeach Alta Exemption Request and the related party transaction.

A designeeOn February 27, 2019, the Board voted to increase the size of Arch Coal, Inc. ("Arch") held one seat on the Company’s Board through June 2017. The appointment of this designeefrom five directors to seven directors and appointed Brian Leen to the Board to fill one of the resulting vacancies effective February 27, 2019. Mr. Leen served as President and Chief Executive Officer of Carbon Solutions until December 7, 2018, the date of the Carbon Solutions Acquisition.

In connection with the Carbon Solutions Acquisition, Mr. Leen's position with Carbon Solutions was madeeliminated. Mr. Leen and the Company entered into a Release of Claims and Separation Agreement (the "Separation Agreement"), pursuant to a 2003 subscription, as amended pursuant towhich the Company’s 2:1 stock split in March 2014, and investment agreement with Arch, as amended pursuant to the Company's 2:1 stock split in March 2014, whereby the Company’s managementCompany agreed to make available one seat on our Board for an Arch designeepay him $2.2 million in compensation, which included previously agreed to retention bonuses plus a year of severance pay in the form of salary and bonuses, over the 52 weeks following the effective date of this Separation Agreement.

As a non-employee director, Mr. Leen will receive the compensation offered to vote all shares and proxies they are entitled to vote in favor of such designee for so long as Arch continued to hold at least 200,000 shares of the Company's Common Stock. In addition, as required by the Company's related party transaction policy, the above noted agreements were approved by the Company’s Audit Committee before being recommended tonon-employee directors for services on the Board, for approval and were then approved by the disinterested members of the Board. During the year ended December 31, 2012 and through August 2013, Robert E. Shanklin, the Vice President of Coal Technology of Arch served on the Company's Board. Upon Mr. Shanklin's resignation, from 2013 through 2017, Paul A. Lang, the current President and COO of Arch, served on the Company's Board. In 2017, Arch Coal informed the Company that it no longer held at least 200,000 shares of the Company's Common Stock, and therefore no longer had automatic rights to appoint a director to the Board. Mr. Lang did not stand for re-election to the Board at the Company's 2017 Annual Meeting of Stockholders in June 2017.as disclosed below.

DIRECTOR COMPENSATION

Our Nominating and Governance Committee has responsibility for reviewing the compensation plan for our non-management directors annually and making recommendations to the entire Board for approval. The Nominating and Governance Committee has not delegated authority to any other person to determine director compensation. Our management has made recommendations to the Nominating and Governance Committee regarding their views as to the appropriate amount and form of compensation (i.e., cash or stock) and tax and accounting ramifications of awards. In addition, the executive officer who serves on our Board votes on the recommendations for director compensation made by the Nominating and Governance Committee to the Board.

The Nominating and Governance Committee periodically reviews industry data from the National Association of Corporate Directors Director Compensation Report and Survey Data and evaluates industry averages, personal liability risks and other factors relating to director compensation. The last survey review by the Nominating and Governance Committee, utilizing market data for director compensation from various sources was completed in November 2017. Based on the Nominating and Governance Committee’sCommittee's recommendation in November 2017, no adjustments have been made to director compensation previously set in May 2016, and the Board re-approved director compensation, for non-management Company directors, as described below.

| | | Compensation Component | | January 1, 2017 - December 31, 2017* | | January 1, 2019 - December 31, 2019* |

| Annual Retainer | | $147,850, with at least 30% paid in Company stock | | $147,850, with at least 30% paid in Company stock |

| Chairman of the Board Retainer | | $ | 32,500 |

| | $ | 32,500 |

|

| Chairman of the Audit Committee Retainer | | $ | 20,000 |

| | $ | 20,000 |

|

| Chairman of the Compensation Committee Retainer | | $ | 12,500 |

| | $ | 12,500 |

|

| Chairman of the Nominating and Governance Committee Retainer | | $ | 10,000 |

| | $ | 10,000 |

|

| Chairman of Activated Carbon Committee | | | $ | 25,000 |

|

| Compensation Committee Member Service Retainer | | $ | 10,000 |

| | $ | 10,000 |

|

| Audit Committee Member Service Retainer | | $ | 7,500 |

| | $ | 7,500 |

|

| Nominating and Governance Member Service Retainer | | $ | 5,000 |

| | $ | 5,000 |

|

| Board of Managers of Tinuum Group, LLC Service Retainer (non-management Company directors) | | $ | 20,000 |

| |

| Activated Carbon Committee Member | | | $ | 5,000 |

|

| Board of Managers of Tinuum Group, LLC Service Retainer | | | $ | 20,000 |

|

*Amounts shown are on an annual basis. Unless specified otherwise, all amounts are payable in cash.

In February 2019, the Nominating and Governance Committee created a new committee, the Activated Carbon Committee, which was created to evaluate adjacent market growth opportunities for the activated carbon business. This committee was subsequently disbanded by the Board effective April 8, 2020. While the Active Carbon Committee was in existence, Mr. Leen, served as Chairman and Mr. Simonton and Ms. Eicher served on the committee.

The Compensation Committee retained Lyons, Benenson & Company ("LB & Co."), to provide a market analysis of the Company’s director compensation relative to our peer companies and to recommend the amount and form of such compensation to be paid in the future. Based on this peer company information and other matters considered, the Compensation Committee adjusted director compensation for 2020. For the Annual Retainer, effective January 1, 2020, directors will be paid at least 50% in Company stock. On January 1, 2020, the Company granted an additional 974 shares of common stock to Ms. Eicher, Messrs. Leen, Pate, Simonton and Wells. Cash compensation was reduced.

Due to the current economic environment related to the coronavirus outbreak (COVID-19) and out of an abundance of caution, on April 8, 2020, the Board of Directors voted to reduce by 25% the cash portion of the directors' annual retainer starting in the second quarter of 2020. This decision will be re-evaluated in the third quarter of 2020.

The following table provides information regarding director compensation for the fiscal year ended December 31, 2017:2019: | | | Name | | Fees earned or paid in cash ($) (1) | | Stock awards ($) (2)(3) | | Option awards ($) | | All other compensation | | Total ($) | | Fees earned or paid in cash ($) (1) | | Stock awards ($) (2)(3) | | Option awards ($) | | All other compensation | | Total ($) |

| A. Bradley Gabbard (4) | | 123,495 |

| | 44,353 |

| | — |

| | — |

| | 167,848 |

| |

| Derek C. Johnson (4) | | 100,050 |

| | 59,137 |

| | — |

| | — |

| | 159,187 |

| |

| Carol Eicher | | | 83,042 |

| | 44,564 |

| | — |

| | — |

| | 127,606 |

|

| Brian Leen | | | 118,168 |

| | 44,564 |

| | — |

| | — |

| | 162,732 |

|

Gilbert Li (5)(4) | | 144,369 |

| | — |

| | — |

| | — |

| | 144,369 |

| | 85,901 |

| | 74,270 |

| | — |

| | — |

| | 160,171 |

|

| R. Carter Pate | | 123,495 |

| | 44,353 |

| | — |

| | — |

| | 167,848 |

| | 128,495 |

| | 44,564 |

| | — |

| | — |

| | 173,059 |

|

| J. Taylor Simonton | | 139,120 |

| | 44,353 |

| | — |

| | — |

| | 183,473 |

| | 130,773 |

| | 44,564 |

| | — |

| | — |

| | 175,337 |

|

| L. Spencer Wells | | 155,995 |

| | 44,353 |

| | — |

| | — |

| | 200,348 |

| | 165,995 |

| | 44,564 |

| | — |

| | — |

| | 210,559 |

|

| Paul A. Lang (6) | | 46,664 |

| | — |

| | — |

| | — |

| | 46,664 |

| |

(1) The cash amounts earned by each director are made up of the following amounts:

| | | Name | | Annual Retainer | | Annual Committee Chair Retainer | | Annual Committee Retainer | | Total ($) | | Annual Retainer | | Annual Committee Chair Retainer | | Annual Committee Retainer | | Total ($) |

| A. Bradley Gabbard (4) | | 103,495 |

| | — |

| | 20,000 |

| | 123,495 |

| |

| Derek C. Johnson (4) | | 82,550 |

| | 7,500 |

| | 10,000 |

| | 100,050 |

| |

| Carol Eicher | | | 73,514 |

| | 3,778 |

| | 5,750 |

| | 83,042 |

|

| Brian Leen | | | 97,335 |

| | 20,833 |

| | — |

| | 118,168 |

|

Gilbert Li (5)(4) | | 129,369 |

| | — |

| | 15,000 |

| | 144,369 |

| | 43,123 |

| | 6,222 |

| | 36,556 |

| | 85,901 |

|

| R. Carter Pate | | 103,495 |

| | 12,500 |

| | 7,500 |

| | 123,495 |

| | 103,495 |

| | 12,500 |

| | 12,500 |

| | 128,495 |

|

| J. Taylor Simonton | | 103,495 |

| | 20,000 |

| | 15,625 |

| | 139,120 |

| | 103,495 |

| | 20,000 |

| | 7,278 |

| | 130,773 |

|

| L. Spencer Wells | | 103,495 |

| | 32,500 |

| | 20,000 |

| | 155,995 |

| | 103,495 |

| | 32,500 |

| | 30,000 |

| | 165,995 |

|

| Paul A. Lang (6) | | 39,372 |

| | — |

| | 7,292 |

| | 46,664 |

| |

(2) The grant date fair value of each share of our Common Stock granted to non-employee directors over their past year of service to us is set forth in the following table and is computed in accordance with FASB ASC Topic 718, based on the close price on the date of determination. There were no forfeitures by directors during fiscal 2017.

2019.

|

| | | | | | | | | |

| Grantee | | Shares | | Value | | Determination Date |

| Gabbard, Johnson, Pate, Simonton and Wells (6) | | 25,825 |

| | $ | 236,560 |

| | 7/1/2017 |

|

| | | | | | | | | |

| Grantees | | Shares | | Value | | Determination Date |

| Eicher, Leen, Li, Pate, Simonton and Wells | | 23,393 |

| | $ | 297,091 |

| | 7/1/2019 |

(3) As of December 31, 2017,2019, our non-employee directors held the following number of shares of unvested restricted stock, which were granted in 2017:2019: Ms. Eicher—1,755, Mr. Gabbard—2,422,Leen—1,755, Mr. Johnson—3,228,Li—2,924, Mr. Li—0,Pate—1,755, Mr. Pate—2,422, Mr. Simonton—2,4221,755 and Mr. Wells—2,422.1,755.

(4) Messrs. Gabbard and Johnson have chosen not to stand for re-election at the Annual Meeting and will cease being directors at that time.

| |

(5) | Mr. Li received his annual retainer in cash to ensure Mr. Li did not trigger an "ownership change" as defined in Section 382 of the Internal Revenue Code. |

(6) Cash fees and shares issued for services from Mr. LangLi were paid or issued to Arch Coal, Inc.Alta Fundamental Advisers LLC. Mr. Lang servedLi received his 2018 annual retainer in shares as a director ofhis company was granted exemption under the Company until June 20, 2017.TAPP.

All directors receive reimbursement for reasonable out-of-pocket expenses incurred in connection with meetings of our Board.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Common Stock

The following table provides information with respect to the beneficial ownership of the Company’sCompany's Common Stock by (1) each director of the Company, (2) each named executive officer currently serving the Company, (3) all directors and executive officers as a group, and (4) each person beneficially owning more than 5% of our outstanding Common Stock. We base the share amounts shown on each person’sperson's beneficial ownership as of March 31, 2018,2020, including options exercisable within 60 days thereof, unless we indicate some other basis for the share amounts. Percentage ownership is calculated based on 20,923,62318,289,623 shares outstanding as of March 31, 2018,2020, including securities deemed outstanding pursuant to Rule 13d-3(d)(1) under the Exchange Act. For persons beneficially owning more than 5% of our outstanding Common Stock, the Company has used the most recent ownership filings related to the below table. Except as noted below, each of the persons named below has sole voting and investment power for the respective shares.

|

| | | | | | |

| Name (1) | | Current Shares Beneficially Owned (1) | | Percent of Shares Beneficially Owned |

| A. Bradley Gabbard (2) | | 34,480 |

| | * |

|

| Ron Hanson | | 35,091 |

| | * |

|

| Derek C. Johnson (2) | | 47,000 |

| | * |

|

| Gilbert Li (3) | | 1,286,334 |

| | 6.15 | % |

| Greg P. Marken | | 46,629 |

| | * |

|

| R. Carter Pate | | 11,054 |

| | * |

|

| L. Heath Sampson (4) | | 636,941 |

| | 2.99 | % |

| Ted J. Sanders | | 26,580 |

| | * |

|

| J. Taylor Simonton (5) | | 27,109 |

| | * |

|

| Sharon M. Sjostrom | | 66,506 |

| | * |

|

| L. Spencer Wells (6) | | 27,065 |

| | * |

|

| Group Total | | | | |

| All Directors and Executive Officers as a Group (11 persons) | | 1,839,457 |

| | 10.52 | % |

| Certain Other Owners: | | | | |

| BlackRock, Inc. (7) | | 4,164,562 |

| | 19.90 | % |

| Apollo Global Management, LLC (8) | | 2,052,794 |

| | 9.81 | % |

| Franklin Resources, Inc. (9) | | 1,724,209 |

| | 8.24 | % |

| Greywolf Event Driven Master Fund (10) | | 1,239,210 |

| | 5.92 | % |

|

| | | | | | |

| Name (1) | | Current Shares Beneficially Owned (1) | | Percent of Shares Beneficially Owned |

| Carol Eicher | | 4,483 |

| | * |

|

| Brian Leen | | 4,483 |

| | * |

|

| Gilbert Li (2) | | 1,966,647 |

| | 10.75 | % |

| Greg P. Marken | | 59,982 |

| | * |

|

| R. Carter Pate | | 19,441 |

| | * |

|

| L. Heath Sampson (3) | | 625,905 |

| | 3.37 | % |

| Ted J. Sanders | | 40,827 |

| | * |

|

| J. Taylor Simonton | | 25,496 |

| | * |

|

| L. Spencer Wells | | 25,452 |

| | * |

|

| Joe M. Wong | | 22,161 |

| | * |

|

| All Directors and Executive Officers as a Group (10 persons) | | 2,794,877 |

| | 15.03 | % |

| Certain Other Owners: | | | | |

| BlackRock, Inc. (4) | | 2,486,213 |

| | 13.59 | % |

| Franklin Resources, Inc. (5) | | 1,724,209 |

| | 9.43 | % |

| The Vanguard Group, Inc. (6) | | 1,053,378 |

| | 5.76 | % |

* Less than 1%

| |

| (1) | Except as otherwise noted and for shares held by a spouse and other members of the person's immediate family who share a household with the named person, the named persons have sole voting and investment power over the indicated shares. This column also includes shares held in trust that are beneficially owned. Beneficial ownership of some or all of the shares listed may be disclaimed. The address of each of our named executive officers and directors is 640 Plaza Drive, Suite 270, Highlands Ranch, CO 80129. |

| |

| (2) | Our current directors, Messrs. Gabbard and Johnson have chosen not to stand for re-election to the Board at the annual meeting.

|

| |

(3) | Based on a Form 4 filed for Alta Fundamental Advisers LLC on December 15, 2017January 2, 2020 with the SEC reporting beneficial ownership as of that date.December 31, 2019. Alta Fundamental Advisers LLC has sole voting power over 1,286,3341,966,647 shares and sole dispositive power over 1,286,3341,966,647 shares. Alta Fundamental Advisers LLC's address is 777 Third Avenue, Suite 19A, New York, NY. Mr. Li, a member of the Board of Directors, is also a Manager of Alta Fundamental Advisers LLC and has dispositive powers.powers over these shares. |

(4)(3) Includes 385,332300,000 shares of common stock that Mr. Sampson has the right to acquire within 60 days of March 31, 2018, upon the exercise of stock options.

(5) Includes 10,000 shares of common stock that Mr. Simonton has the right to acquire within 60 days of March 31, 2018, upon the exercise of stock options.

(6) Includes 10,000 shares of common stock that Mr. Wells has the right to acquire within 60 days of March 31, 2018,2020, upon the exercise of stock options.

| |

(7)(4) | Based on schedule 13G/A filed by BlackRock, Inc. on January 19, 2018February 4, 2020 with the SEC reporting beneficial ownership as of December 31, 2017.2019. BlackRock, Inc. has sole voting power over 4,162,6552,470,636 shares and sole dispositive power over 4,164,5622,486,213 shares. BlackRock, Inc.'s address is 55 East 52nd Street, New York, NY. |

| |

(8)(5) | Based on schedule 13G filed by Apollo Management Holdings GP, LLCFranklin Resources, Inc. on February 12, 20187, 2017 with the SEC reporting beneficial ownership as of December 31, 2017. Apollo Management Holdings GP, LLC2016. Franklin Resources, Inc. has shared voting power over 1,171,4801,724,209 shares and shareshared dispositive power over 1,171,4801,724,209 shares. Additionally, based on schedule 13F filed by Apollo Management Holdings, L.P. on February 14, 2018 withFrom additional sources, the SEC reportingCompany understands this beneficial ownership information remains correct as of December 31, 2017. Apollo Management Holdings, L.P. has sole voting power over 881,314 shares and sole dispositive power over 881,314 shares. Both Apollo Management Holdings GP, LLC and Apollo Management Holdings, L.P. are managed by Apollo Global Management, LLC (8) and located at 9 W. 57th Street, New York, NY 10019.2019. Franklin Resources, Inc.'s address is 101 John F. Kennedy Parkway, Short Hills, NJ 07078. |

(9)